Algeria’s Minister of Finance, Laaziz Faid, announced on Friday that the country’s public debt remains significantly lower than the benchmark for emerging markets and is well below the levels recorded in most Arab and Mediterranean nations. This, he noted, provides Algeria with the fiscal space to mobilize additional resources through treasury bonds.

Key Indicators of Public Debt

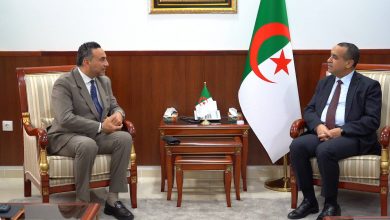

Speaking during a public session at the Council of the Nation to address concerns regarding the 2025 Finance Law, Faid stated that Algeria’s public debt stands at 49.61% of GDP. This figure is expected to reach 16,879 billion dinars by the end of 2023, a level considerably below the 60–70% benchmark for emerging markets.

Ninety-nine percent of this debt is domestic, granting the treasury flexibility to raise funds through treasury markets to finance the fiscal deficit projected for 2025. Comparatively, Algeria’s public debt is far below that of countries like Greece, Italy, France, and Spain, where debt levels exceed 110% of GDP.

Strategies to Address Fiscal Deficits

To cover the 2025 budget deficit, Faid outlined plans to draw from resources accumulated in the Revenue Regulation Fund, which is expected to include an additional 500 billion dinars by year’s end. Additional funds will also come from surplus hydrocarbon revenues in 2024 and domestic borrowing mechanisms.

Supporting Citizens Amid Rising Prices

In response to global price surges, the government has allocated 600 billion dinars in subsidies for widely consumed goods, reaffirming its commitment to alleviating economic pressures on citizens. The 2025 Finance Law also introduces measures aimed at ensuring food security and sustaining subsidies for essential products.

Financial Market Expansion

Faid highlighted the success of listing the Crédit Populaire d’Algérie (CPA) bank on the stock market, which attracted over 112 billion dinars in investments. This historic achievement is considered one of the largest financial operations in Africa and marks a transformative milestone for Algeria’s financial sector.

Investment and Development Initiatives

The state treasury has allocated 5,969 billion dinars in loans to finance 267 projects across 11 economic sectors, reflecting its commitment to driving investment. For local development, 1,433 billion dinars have been earmarked in the upcoming budget, with 60% directed toward southern and highland regions.

Examples of funded projects include the construction of a 60-bed hospital in Tinzaouatine, which received a re-evaluated allocation of 418.43 million dinars, and the dualization of National Road 01 between Ghardaïa and El Menia, with phased funding planned for its completion.

Tindouf Free Trade Zone

The minister also addressed progress in establishing the Tindouf Free Trade Zone, following the May issuance of the executive decree and the subsequent ministerial allocation in August. This initiative aims to boost Algeria’s trade and export capabilities.

Digital Transformation of Financial Services

Faid emphasized ongoing efforts to digitize and modernize Algeria’s financial institutions to enhance transparency and efficiency, aligning with the nation’s broader development goals.

A Stable Path Forward

The Council of the Nation is set to vote on the 2025 Finance Law on Saturday, following its approval by the People’s National Assembly earlier this week. This legislation underpins Algeria’s strategy to balance fiscal discipline with economic growth, reinforcing the nation’s stability in a volatile global landscape.

For more updates, visit DZWATCH.DZ.

Author: Nor-Eleslam

Algeria’s public debt remains among the lowest in Arab and Mediterranean nations.